How to Apply Canadian Tax Exemption

On August 1, 2024, we will start collecting Canadian indirect taxes for all orders in compliance with Canadian Tax requirements. If your business has a valid Goods and Services Tax (GST)/ Harmonized Sales Tax (HST) number with the Canada Revenue Agency or a valid Quebec Sales Tax (QST) number with Revenu Quebec, you can update your Bluehost Portal so that we will not be required to collect sales tax on your orders.

Adding Tax Exemption

Follow the steps below to add your GST/HST or QST number:

- Log in to your Bluehost Portal

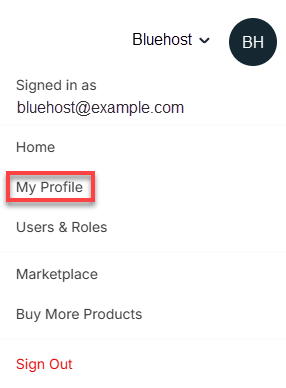

- Click your user profile icon in the upper right corner, and select My Profile.

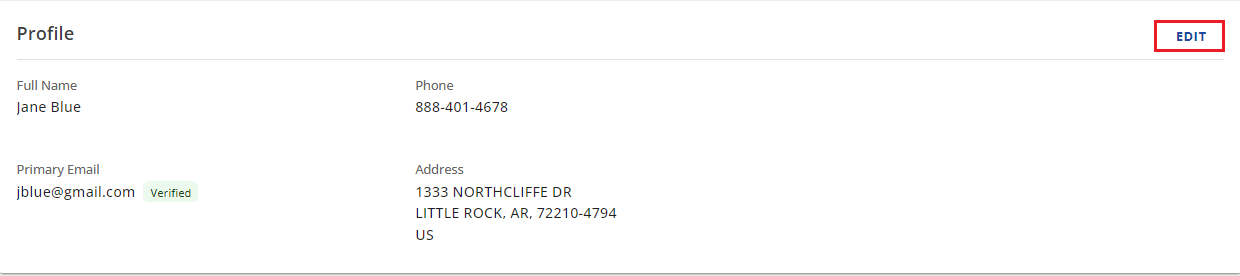

- Click the EDIT button in the Profile section.

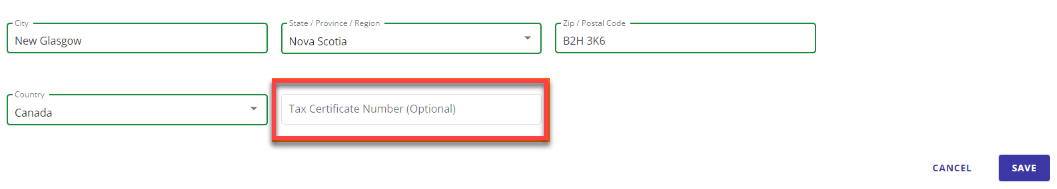

- Enter your GST/HST number in the Tax Certificate Number field, then click the SAVE button.

For residents of Quebec, it’s possible to add the federal exemption or the GST/HST number along with the QST number, and then click the SAVE button. The State Tax Certificate Number field will only appear if your province is Quebec.

Summary

Bluehost now collects Canadian taxes on orders. Businesses with valid GST/HST or QST numbers can apply for exemption by updating their profile in Bluehost Portal. Enter the tax certificate number under My Profile and save. Support is available via chat or phone.

If you need further assistance, feel free to contact us via Chat or Phone:

- Chat Support - While on our website, you should see a CHAT bubble in the bottom right-hand corner of the page. Click anywhere on the bubble to begin a chat session.

- Phone Support -

- US: 888-401-4678

- International: +1 801-765-9400

You may also refer to our Knowledge Base articles to help answer common questions and guide you through various setup, configuration, and troubleshooting steps.