VAT (Value Added Tax)

VAT is a tax on consumer spending within the territory of a European Member State (EU). VAT is not included in prices displayed on Bluehost's site. When applicable, VAT is charged separately and will be itemized on invoices and billing information.

As a non-E.U. Supplier of web-hosting services to customers in the European Union (E.U.), Bluehost is required to comply with the European VAT (Value Added Tax) regulations and charge VAT to customers located in the E.U.

Customers categorized as Business users in the E.U. may be required to self-account for VAT under EC Directive 2006/112, Art 196, using the reverse charge mechanism. For Bluehost to determine if you may fall into this category and not charge you VAT, you must supply all required information.

If your hosting account accrues charges BEFORE you supply the necessary information to Bluehost, VAT will be charged on all purchases prior to the change.

Supplying the VAT Registration Number

If you are an E.U. business or charity customer and you have a valid VAT ID, please supply Bluehost with your VAT Registration Number.

If you are not familiar with the VAT self-accounting rules in your country, please contact your accountant or professional adviser for more information.

- Log in to your Bluehost Portal.

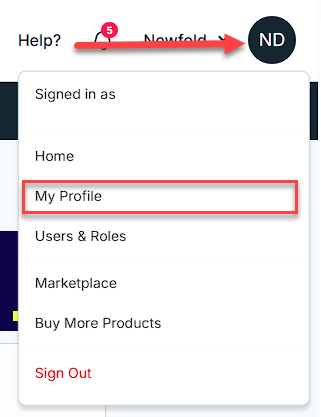

- Click your name at the top right of the screen and select My Profile.

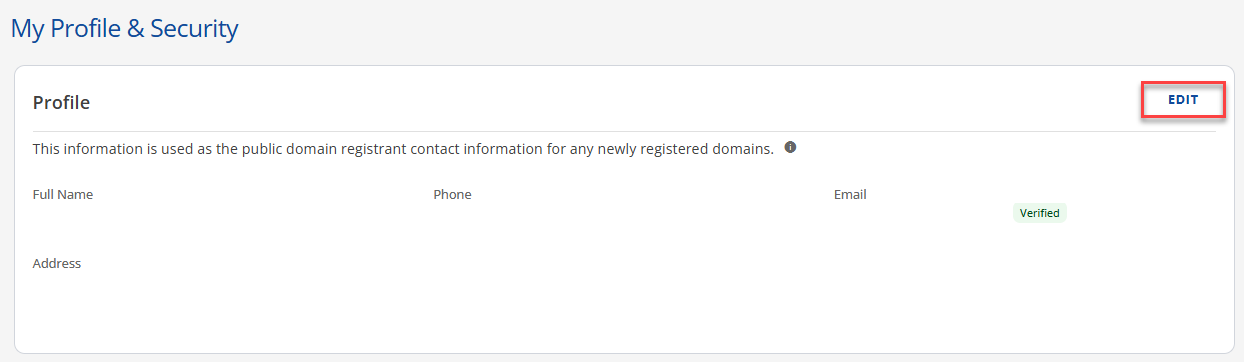

- Under the Profile section in My Profile & Security, click the EDIT button.

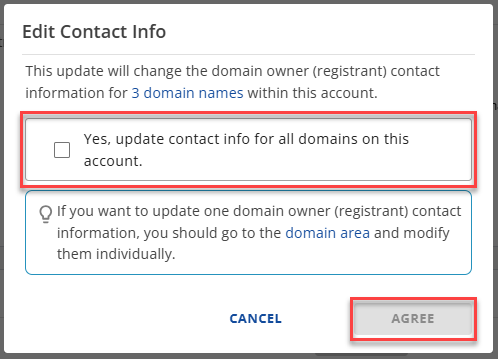

- The Edit Contact Info window will appear. This will change the domain owner for all your domain names within the account.

- If you're operating as a Business or Charity, enter your VAT Registration Number.

- Click Save.

Summary

This article explains how VAT applies to E.U. customers using Bluehost’s web-hosting services. VAT isn’t included in listed prices and is added at checkout when required. E.U. business or charity customers may avoid VAT charges by providing a valid VAT ID, allowing them to self-account under the reverse charge rule. Instructions are included for updating VAT details in your account.

If you need further assistance, feel free to contact us via Chat or Phone:

- Chat Support - While on our website, you should see a CHAT bubble in the bottom right-hand corner of the page. Click anywhere on the bubble to begin a chat session.

- Phone Support -

- US: 888-401-4678

- International: +1 801-765-9400

You may also refer to our Knowledge Base articles to help answer common questions and guide you through various setup, configuration, and troubleshooting steps.