Key highlights

- Know how secure eCommerce payment options increase customer trust and drive more successful checkouts.

- Learn why offering multiple payment methods helps you reach diverse customer preferences and boost sales.

- Understand the key selection factors like transaction fees, mobile optimization, customer experience and brand credibility.

- Uncover the strengths of popular payment providers for flexibility, mobile use, physical stores and brand recognition.

- Assess your business needs to choose payment solutions that align with your sales volume, audience, technical requirements and growth objectives.

Every abandoned cart represents lost revenue, and many of those losses happen at checkout due to limited payment options for eCommerce. When customers can’t pay the way they prefer, they’ll drop off instantly, no matter how great your products are.

The right eCommerce payment options do more than process transactions. They build trust, boost customer satisfaction and encourage repeat purchases. Whether you’re serving local buyers, global audiences or even in-person customers, flexible and secure payment solutions make your store feel reliable and easy to buy from.

In this blog, we’ll explore how choosing the best eCommerce payment options can streamline checkout, support your business growth and keep customers coming back.

What is an eCommerce payment system?

An eCommerce payment system is the digital setup that allows you to securely accept payments online. It includes an eCommerce payment gateway that encrypts and transmits customer payment details. A payment processor handles the transaction.

This system supports various accepted payment methods such as debit/credit card payments, digital wallets and bank transfers. So, customers can pay conveniently and securely on your site. It also provides clear payment references for tracking and reconciliation of eCommerce transactions.

Why is having the right payment system so important?

Choosing the right eCommerce payment options is crucial for your online store’s success. Here are some key benefits of implementing secure and flexible payment solutions that cater to your customers’ needs:

- Builds customer trust by providing a secure and reliable checkout experience

- Reduces cart abandonment by offering familiar and convenient payment options

- Supports multiple payment methods to cater to diverse customer preferences

- Ensures smooth transaction processing with fewer payment errors and delays

- Protects your business and customers with robust fraud prevention measures

- Enhances customer satisfaction and loyalty, encouraging repeat purchases

- Enables seamless management of financial transactions and funds flow

- Facilitates business growth by accommodating increasing transaction volumes and international sales

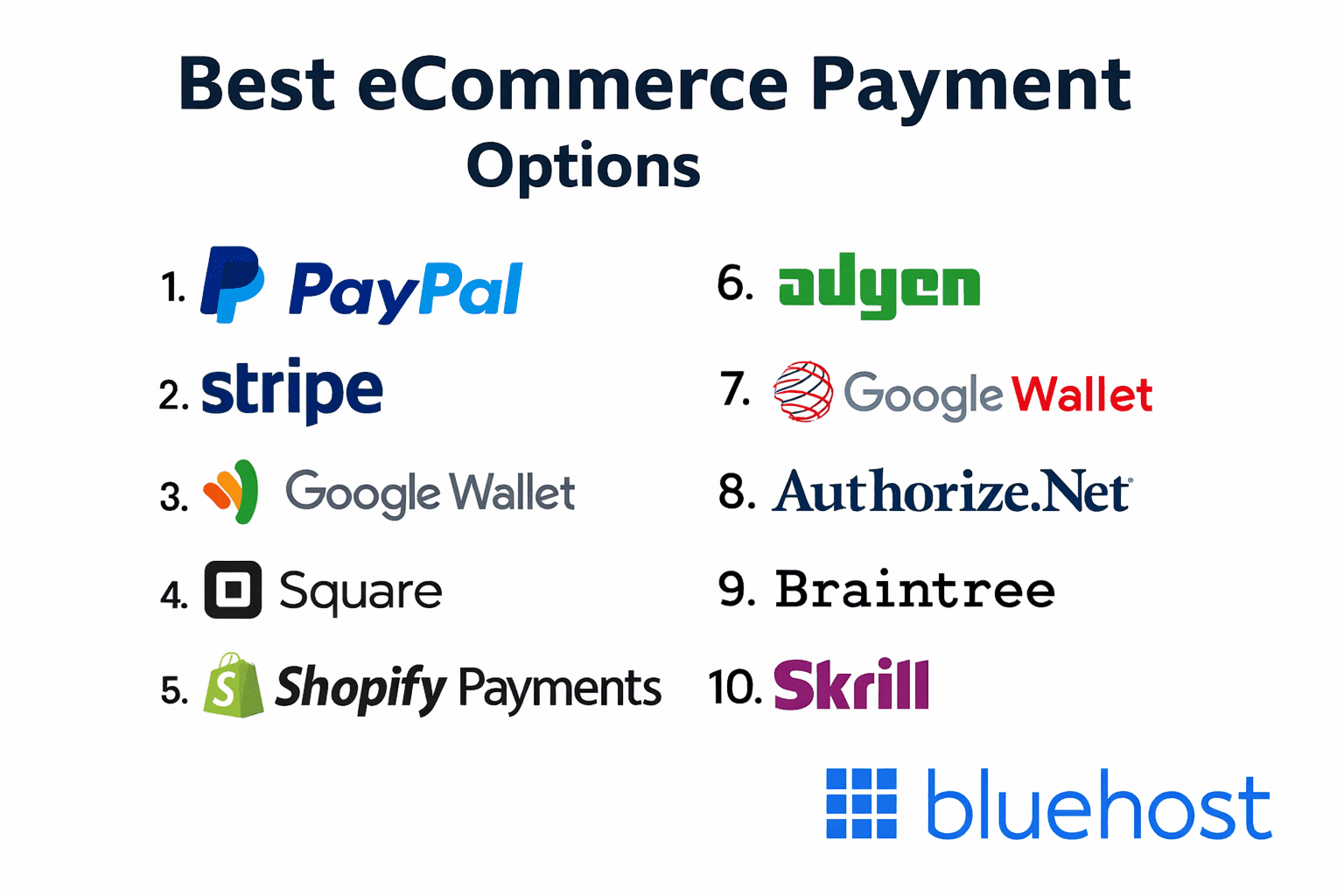

What are some of the best eCommerce payment options?

We’ve put together a list of payment solutions that could be highly beneficial for your online store. Remember, it’s always wise to research each option to find the best fit for your business before making a final decision. These represent some of the most popular payment methods used by eCommerce businesses today.

1. PayPal

PayPal is a trusted and widely recognized online payment system for eCommerce stores. It offers an all-in-one business account solution that helps merchants manage personal and business finances separately.

PayPal’s built-in fraud protection provides security for both merchants and shoppers, enhancing customer confidence and potentially increasing conversion rates. Integration with platforms like WooCommerce allows easy setup and flexibility as your business grows.

- Trusted by millions worldwide, enhancing buyer confidence

- Offers built-in fraud protection at no extra cost

- Helps keep business and personal finances better organized

- Easily integrates with WordPress and WooCommerce via plugins

- Allows testing and switching between payment providers without site rebuilds

Once you’ve decided which payment gateways you want to offer, the next step is making sure they’re easy to plug into your store. If you’re building WordPress with WooCommerce, you don’t have to wrestle with complex setup screens or custom code. Our WooCommerce hosting at Bluehost includes built-in tools that let you connect popular gateways like PayPal and Stripe in just a few clicks, so you can start accepting payments faster and with fewer headaches.

2. Stripe

Stripe is a flexible, scalable payment gateway favored by both small businesses and global brands. It supports all major credit and debit cards worldwide and can be customized to accept alternative payment methods. Stripe offers developer-friendly tools and simple plug-and-play integrations, making it easy to handle high transaction volumes as your eCommerce business grows.

- Supports major credit and debit cards internationally

- Customizable to accept various alternative payment options

- Offers developer-friendly tools and a hosted Stripe Checkout page

- Handles high transaction volumes efficiently

- Trusted by global brands like Booking.com and ASOS

Also read: WooCommerce Payments: Everything You Need To Know in 2026

3. Square

Square is ideal for businesses with physical retail locations looking to expand online, but it also suits online-only sellers. It offers a robust eCommerce website builder with drag-and-drop themes for easy, code-free store creation. Square integrates seamlessly with popular platforms like WordPress and WooCommerce, providing a unified payment gateway solution without ongoing monthly fees.

- Suitable for both physical and online stores

- Provides a drag-and-drop website builder with customizable themes

- Integrates with major eCommerce platforms like WooCommerce and Wix

- Charges 2.9% + $0.30 per transaction with no monthly fees

- Synchronizes payment gateways with preferred systems easily

4. Google Wallet

Google Wallet leverages Google’s trusted reputation to boost customer confidence during checkout. It offers a fast, simple 2-click mobile payment process, streamlining transactions on mobile devices. While it requires customers to have a Google account with a linked payment card, it also allows merchants to use Google Offers for promotions across Google’s network.

- Trusted by users familiar with Google ecosystem

- Enables quick 2-click mobile payments for faster checkout

- Integrates promotional tools like Google Offers

- Requires customers to have a Google account with linked payment card

- Ideal for returning customers, with some friction for new users

5. Shopify Payments

Shopify Payments is the native payment gateway for Shopify stores, simplifying payment processing by consolidating order management and analytics. It supports multiple currencies and local payment methods, helping merchants optimize checkout and reduce transaction fees. Shopify Payments requires no third-party setup, making it convenient for Shopify users.

- Native payment gateway integrated with Shopify platform

- Supports multiple currencies and local payment options

- Consolidates payment processing order management and analytics

- No need for third-party payment providers or merchant accounts

- Helps reduce transaction fees for Shopify merchants

6. Adyen

Adyen offers a seamless payment experience for both online and in-person sales, focusing on mobile payments and real-time analytics. It supports over 180 currencies and 200 payment methods globally, making it ideal for enterprise businesses seeking extensive international reach and advanced fraud protection.

- Supports 180+ currencies and 200+ payment methods worldwide

- Provides real-time analytics for better business insights

- Focuses on mobile payment optimization

- Suitable for large enterprises with global sales

- Offers advanced fraud detection and security features

7. Worldpay

Worldpay delivers secure, integrated payment solutions designed for high-volume businesses operating in global markets. It supports a wide range of payment methods, including credit and debit cards, digital wallets, local payment options and cryptocurrencies, making it versatile for international commerce transactions.

- Handles high transaction volumes efficiently

- Supports major credit and debit cards, digital wallets and cryptocurrencies

- Integrates with numerous third-party applications

- Operates in over 150 countries and supports 120+ currencies

- Ideal for businesses with global customer bases

8. Authorize.net

Authorize.net provides multiple payment options such as virtual terminals, recurring billing and contactless payments. Its advanced fraud detection and customer information management make it a reliable choice for businesses seeking diverse payment methods with strong security.

- Supports virtual terminals and recurring billing

- Offers contactless payment options

- Includes advanced fraud detection algorithms

- Manages customer information securely

- Suitable for businesses needing multiple payment options

9. Braintree

Owned by PayPal, Braintree is a flexible full-stack payment platform known for ease of use and multiple payment options. It supports PayPal, Venmo, credit and debit cards, digital wallets and local payment methods. Braintree’s secure vault feature securely stores customer payment data for recurring billing and subscriptions.

- Supports PayPal, Venmo, credit/debit cards and digital wallets

- Offers secure vault for storing payment information

- Simplifies recurring billing and subscription management

- Known for flexibility and easy integration

- Operates in over 45 countries and supports 130+ currencies

10. Skrill

Skrill specializes in low-cost international transactions and supports over 40 currencies. It offers instant deposits and payouts, which are beneficial for retailers managing cash flow. Skrill also includes strong security measures such as two-factor authentication and SSL encryption.

- Supports 40+ currencies for international payments

- Provides instant deposits and payouts

- Focuses on low-cost transaction fees

- Includes two-factor authentication and SSL encryption

- Ideal for businesses concerned about cash flow management

Once you’ve determined which payment options work best for your eCommerce store, be sure to optimize your payment process to maximize conversions and create a smooth checkout experience. Explore the following best practices to help you get the most from your eCommerce payment systems.

How does eCommerce payment processing work?

Understanding how eCommerce payments work helps you choose the right payment system for your store. When customers click “Buy Now,” several financial institutions work together to securely transfer money from their account to yours.

Here’s the step-by-step process of every online transaction:

- Customer enters payment details and clicks “Buy Now” on your checkout page.

- Payment gateway encrypts the transaction data and sends it to your payment processor.

- Payment processor forwards the information to the card network (Visa, Mastercard, etc.).

- Card network contacts the customer’s issuing bank to verify account details and available funds.

- Issuing bank approves or declines the transaction and sends a response back through the chain.

- Your acquiring bank receives approval and processes the payment.

- Funds are deposited into your merchant account within 1-3 business days, minus processing fees.

This entire process happens in seconds, providing customers with instant purchase confirmation while ensuring secure, verified transactions for your business.

With a clear understanding of payment processing, it’s helpful to know the various types of payment methods available for your online store. Each method has its own strengths and considerations that can affect your customers’ checkout experience.

What are the main types of eCommerce payment methods?

When setting up your online store, it’s important to provide your customers with a choice of secure and convenient payment methods. The right mix of options payment options for eCommerce can boost trust, reduce cart abandonment and ultimately improve your store’s conversion rate. Here are the main types of eCommerce payment methods to consider:

Traditional payment methods (credit & debit cards)

- Most widely used eCommerce payment option

- Offer familiar checkout experiences trusted by customers

- Provide strong fraud protection and universal acceptance

- Often involves higher processing fees for merchants

- Require customers to manually enter card details

Digital wallets (PayPal, Google Pay, Apple Pay)

- Securely store customer payment information for fast one-click purchases

- Enable faster checkouts and enhanced payment security-card details aren’t shared with merchants

- Help businesses reduce cart abandonment rates

- Include built-in fraud protection

- May charge premium processing fees

Bank transfers and ACH payments

- Lower processing costs for merchants

- Allow direct account-to-account transactions

- Ideal for high-value transactions or recurring payments

- Usually processes slower than other payment methods

- May be less convenient for impulse purchases

Buy Now, Pay Later (BNPL) Services (Klarna, Afterpay)

- Let customers split purchases into manageable installments

- Appeal to budget-conscious shoppers

- Increase average order values

- Attract younger shoppers who prefer flexible payment options

Among the various eCommerce payment options, merchant accounts remain a foundational solution for many online retailers. Next, let’s take a closer look at what merchant accounts are and how they compare to other popular payment methods.

Understanding merchant accounts for eCommerce payments

A merchant account is a special type of bank account that lets your online store accept and process card payments securely. It sits between your customer’s bank and your business bank account, acting as a trusted bridge for every transaction. It is usually provided and supported by banks or established payment processors.

Benefits of using a merchant account

- Adds credibility as an official, verified vendor.

- Backed by leading financial institutions, which help build customer trust.

- Offers robust security standards and stable processing for growing eCommerce stores.

Challenges to consider

- Setup can be complex and time-consuming, especially for small businesses.

- May require paperwork, approval and underwriting from the provider.

- Customers often must enter card details directly on your site, which can feel tedious on mobile.

- Extra steps at checkout can increase friction and lead to abandoned carts.

How does this fit into choosing the right payment options?

- Merchant accounts are a strong option for reliability and control, but they may not suit every business.

- Many online stores combine merchant accounts with other payment options for eCommerce (like payment gateways or digital wallets) to reduce friction and improve user experience.

- Comparing merchant accounts with other top-rated solutions helps you find the right mix of security, flexibility and convenience for your customers and your business.

What are some best practices for optimizing eCommerce payments?

Optimizing your eCommerce payment process is crucial for delivering a positive shopping experience, building customer trust and increasing conversion rates. Follow these best practices to reduce friction at checkout and support long-term business growth:

- Create a seamless mobile experience: Most customers now order via smartphones and expect quick, intuitive payments.

- Streamline your checkout process: Minimize form fields, allow guest checkout and make payment buttons large and easy to tap.

- Display trust badges clearly: Show SSL certificates and security logos near payment forms to reassure customers.

- Be transparent about costs: Show all fees upfront, including shipping and taxes, to build trust and reduce cart abandonment.

- Offer multiple eCommerce payment options: Include credit and debit cards, PayPal, Google Pay and other popular online methods.

- Optimize payment gateway integration: Reduce loading times and steps to complete a purchase for a faster experience.

- Test your checkout regularly: Check on different devices and browsers to find and fix friction points.

- Choose reliable hosting: Opt for secure and easy-to-use hosting solutions to provide a solid foundation for smooth and secure payment processing.

We at Bluehost offer WooCommerce hosting with secure payment processing, automatic malware scanning and built-in DDoS protection to keep every transaction safe. You also get fast performance, 1-click checkout tools and a fully optimized store setup designed to handle traffic spikes without slowing down.

Final thoughts

As a store owner, choosing the right eCommerce payment system is one of your most important decisions. You need clarity on transaction fees, security and which payment options your customers trust most. When you understand how payment gateways, processors and methods work together, you can build a smooth, secure checkout that supports conversions and repeat sales.

With the right guidance, you can confidently set up payment solutions that fit your business needs and customer expectations. At Bluehost, we offer WooCommerce hosting built to help store owners simplify eCommerce payment setup, manage secure payments and scale with ease.

Ready to give your customers a seamless checkout experience? Get started with Bluehost WooCommerce hosting today and discover how easy it is to choose the right payment options for your online store.

FAQs

PayPal and Stripe are the best payment methods for a new online store. They’re easy to set up, widely trusted and help build quick customer confidence. As your store grows, you can add more options based on your audience and sales volume.

Choose a PCI DSS–compliant provider with strong fraud tools like real-time monitoring and risk alerts. Secure your site with SSL so customer data is encrypted during checkout. Many hosts, including Bluehost, provide free SSL to add extra trust.

On the WooCommerce website, install your preferred payment provider’s plugin, connect your account, add API keys and set currencies and fees. Most gateways offer step-by-step guides, so you can go live without heavy coding.

Payment reconciliation means matching store orders with records from your payment gateway and bank. This helps keep your books accurate, catch errors early and spot potential fraud.

Compare transaction fees, security features and how easily the gateway integrates with your platform. Prioritize PCI compliance, solid fraud protection and support for your customers’ preferred payment methods and currencies.