Key highlights

- Track record-breaking sales of Black Friday that outperformed the previous year’s holiday season sales.

- Spot key shopping days that drove massive consumer spend both online and in stores.

- Compare in-store Black Friday shopping trends with the surge in online-only retailer performance.

- Monitor rising mobile phone purchases, fueling over half of total online spending this holiday season.

- Review updated Black Friday statistics showing how shoppers spent more across digital channels.

If you thought the previous year’s Black Friday broke records, 2025 is set to go even further. Consumers spent more in online sales than ever, with record-breaking global online sales driven by smarter discounts and mobile-first shopping.

The holiday shopping season has officially gone digital and people are browsing on mobile phones and apps, comparing prices in real time and checking out within seconds.

In this Black Friday season statistics report, we’ll explore the Black Friday data and stats, from digital shopping trends to holiday purchases. and what they mean for brands gearing up for the biggest shopping event of the year.

TL;DR: Black Friday statistics 2025

– U.S. online sales hit $70.8B in 2024 — a 5% YoY increase (Salesforce).

– Mobile shopping now accounts for 56% of all online purchases.

– Global Black Friday spending topped $298B in 2024 — up 6% YoY.

– AI-driven recommendations boosted sales by 9% across major retailers.

– Keep your site fast and stable this season with Bluehost hosting (70% OFF).

Black Friday stats: Sales volume

The latest Black Friday stats highlight steady growth across both online and in-store channels, proving that shoppers are spending more and doing it digitally.

Here’s what the Black Friday in numbers looked like in 2023 during the thanksgiving weekend (setting the tone for 2025’s record-breaking predictions):

- Adobe Analytics reports record online holiday spending — Cyber Monday up 7.3% YoY to $13.3B and Cyber Week up 8.2% to $41.1B.

- In the U.S., online sales increased by 5% YoY,hitting $70.8 billion, according to Salesforce.

- Total U.S. online retail sales on Black Friday rose 14.6% YoY, showing healthy growth despite early-season promotions.

- In-store shopping saw a modest 1.1% increase, compared with an 8.5% boost for ecommerce, per Mastercard.

- Cyber Week global sales also climbed 6% YoY, reaching an impressive $298 billion in 2023.

Black Friday shopper statistics

Black Friday 2023 proved once again that it’s both an in-store and online phenomenon — but the data shows a clear tilt toward digital.

Here’s what the numbers reveal about how Americans shopped previous year:

- According to Omnisend, U.S. consumers plan to spend nearly $80B during Black Friday and Cyber Monday, up $20B from last year.

- Prime Day 2024 hit $14 billion in sales, ranking among the biggest online shopping events in the U.S.

- Consumers plan to spend an average of $1,595 this holiday season i.e. a 10% decrease compared to previous year, as per Deloitte’s 2025 Holiday Retail Survey.

- Cyber Week (the 5-day period including Thanksgiving, Black Friday and Cyber Monday) is expected to drive 17.2% of overall spend this season 2025.

Black Friday consumer global spending statistics

Global shoppers are spending smarter and sooner this Black Friday season. From mobile-first purchases to AI-powered deal discovery, here’s a look at what’s driving 2024’s biggest online shopping event.

- Black Friday 2024 is shaping up big, online sales are projected to reach $11.7 billion, up 8.3% year over year.

- Cyber Monday still leads the pack with $14.2 billion in sales, while Cyber Week overall will bring in $43.7 billion, Mobile officially overtakes desktop this year, driving 56% of online sales, worth about $142.7 billion.

- Shoppers are using Buy Now, Pay Later (BNPL) more than ever, spending $20.2 billion this season with $1 billion of that on Cyber Monday.

- Early-bird deals in October are fueling excitement, generating around $9 billion in spending, largely led by Amazon’s Prime Day promotions.

- Aggressive discounts are driving bigger purchases during Cyber week which are expected up to 28% off electronics, 27% off toys and 25% off apparel.

Source: Holiday ecommerce to hit record $253 billion – here’s what’s driving it

Black Friday online traffic statistics

Online traffic trends in 2024 confirmed what retailers have long suspected early access deals and mobile-first browsing have reshaped Cyber Week forever.

- Strong discounts up to 30% will push shoppers to spend over $2 billion more on electronics, appliances and sporting goods.

- The 2024 holiday season will be the most mobile ever, with $128.1 billion spent via phones, making up 53.2% of all online sales.

- Influencers will drive 10x more purchases than regular social media as AI chatbots double retail traffic this season.

- During Black Friday between 10 a.m. and 2 p.m. across U.S. time zones, Americans spent an astounding $11.3 million online every minute.

Use Bluehost’s built-in CDN and caching to handle surges in online traffic during peak Black Friday hours.

Category-Wise Holiday Spending and Year-over-Year Growth (2024)

Here’s a quick look at where consumer spending is expected to rise the most this season.

| Category | 2024 Revenue | YoY Growth | Notes / Insights |

| Electronics | $57.5B | +4.0% | Consistent category growth, strong seasonal performer. |

| Grocery | $23.5B | +9.3% | Outpaces seasonal average but slower than 2023’s 12.9%. |

| Cosmetics | $8.4B | +9.1% | Continues to overperform and gain share. |

| Apparel | $47.6B | +4.4% | Steady growth reflecting strong consumer demand. |

| Toys | $8.8B | +7.3% | Healthy growth driven by new product trends. |

| Furniture & Home Goods | $31.1B | +6.5% | Sustained strength in home improvement and décor. |

| Sporting Goods | $8.2B | +5.1% | Moderate growth supported by premium item sales. |

Source: 2025 Holiday Shopping Forecast

Electronics, apparel, and home goods continue to dominate holiday spending, while fast-growing segments like groceries and cosmetics show shifting consumer priorities.

Black Friday mobile shopping and online order statistics

Mobile shopping continued its unstoppable rise in 2023, cementing its position as the go-to channel for deal hunters using mobile devices.

While reports differ slightly across Black Friday data sources, the overall message is consistent with mobile dominated Black Friday and Cyber Week like never before.

- On Black Friday, mobile’s share peaked at 51.9% (up from 43.9% the prior Friday).

- 57% of Cyber Week online sales came from mobile devices (BigCommerce & Adobe).

- On Black Friday, DNS traffic peaked between 3:00 p.m. and 6:00 p.m. ET (1:00–3:00 p.m. PT), showing an 18% increase at 6:00 p.m. ET compared to the previous week.

- 79% of all eCommerce traffic on Black Friday came from mobile phones, a new record.

- Mobile wallet usage (like Apple Pay) in the U.S. surged 54% YoY on Black Friday, making checkout faster and frictionless.

Black Friday consumer trends

The 2024 shopping season reflected a smarter, faster and more skeptical shopper, one who values deals but demands convenience and authenticity in both in store shopping and online.

- About 66% of shoppers plan to participate in BFCM promotional events this year, up from 49% in 2022, as they look for ways to offset rising prices.

- Shopify merchants pulled in $11.5 billion in sales over Black Friday and Cyber Monday, marking another record-breaking shopping weekend.

- The average cart price in Black Friday was $108.56 ($109.70 on a constant currency basis).

- Over 91 million packages were tracked worldwide through the Shop App during the BFCM weekend.

- In 2024, 76 million shoppers bought from Shopify stores, up 15 million from the previous year’s 61 million.

Black Friday demographics statistics

Demographics reveal how different generations and income groups approach Black Friday and how preferences vary across gender, income and mindset.

- Finder predicts that 58% of American adults will participate in Black Friday sales.

- An estimated 152 million Americans are expected to shop during the event.

- Each shopper is projected to spend an average of $674.

- Americans are anticipated to spend around $102.4 billion on Black Friday deals.

- Walmart, Target and Best Buy together account for over 55% of all Black Friday searches.

- In UK, Millennials are expected to be the biggest spenders on Black Friday 2024, planning to spend an average of £188, just £7 more than Gen Z shoppers.

Statistics of Black Friday Europe

Europe’s Black Friday story in 2023 showed a mature, savvy consumer base — familiar with the event and increasingly selective about where and how they shop, including retail stores .

- In a U.K. survey, 100% of consumers said they knew about Black Friday and one-third said they knew it very well.

- Half of U.K. shoppers said “best value for money” and low prices were their top shopping decision factors.

- In 2023, 30% of French shoppers planned to spend less on Black Friday, compared to under 20% in Italy and Spain.

- Spanish consumers plan to spend around €282 on Black Friday 2024, while German shoppers have the highest average budget at €317.

- In 2024, Italian consumers planned to spend about €264 on Black Friday, a slight increase from the previous year.

Black Friday marketing trends

Marketing in 2023 was a race for attention and digital-first brands led the charge through personalization, push alerts and social commerce.

- Push notifications, SMS and streaming messages increased 37% YoY in this cyber week, compared to just 9% growth for email.

- 55% of consumers took advantage of early holiday promotions.

- 35% shopped during the week leading up to Thanksgiving (Nov 16–22).

- By Cyber Week, 85% of consumers had started their holiday shopping and were about halfway (48%) done.

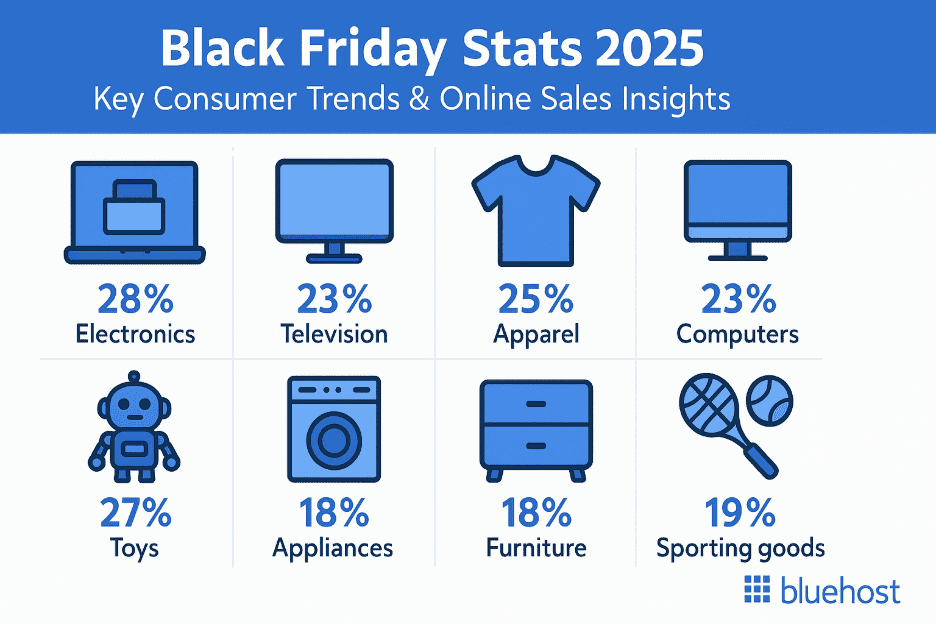

Black Friday deals on top product categories

When it comes to what shoppers are buying, electronics and apparel continue to dominate Black Friday and Cyber Week sales across markets.

The deepest discounts of the 2025 holiday season are expected to reach the following levels (source):

- Electronics: 28%

- Television: 23%

- Apparel: 25%

- Computers: 23%

- Toys: 27%

- Appliances: 18%

- Furniture: 18%

- Sporting goods: 19%

Also read: 10+ Proven Black Friday Advertising Strategies (2025 Guide)

Winter holiday 2025 statistics & predictions

Looking ahead, 2025 is projected to be another record-breaking year for online and mobile shopping.

- Consumers are budgeting an average of $890 for gifts and seasonal items like decorations, cards, food and candy.

- Families with children plan to spend $33 more on gifts than other shoppers.

- 42% of holiday shoppers plan to start browsing and buying before November 2025, but 60% say they won’t finish shopping until December.

Top 5 Reasons Consumers Shop Early (source):

- 54%: To spread out gift shopping budgets

- 41%: To avoid last-minute shopping stress

- 40%: Because prices and promotions are too good to pass up

- 38%: To avoid crowds

- 28%: To have more time to enjoy the holidays

Online vs. in-store shopping preferences

The 2025 holiday shopping season shows a clear split — online shopping keeps growing, but in-store sales still matter. Black Friday drew 87.3 million online and 81.7 million in-store shoppers, showing the continued online edge.

AI’s impact on consumers spent on Black Friday

AI is changing how people shop in store this holiday season, from price checks to gift ideas, impacting Cyber Monday online sales significantly.

- Last Black Friday, ChatGPT had 300 million users. This year, that number has soared to between 700 and 800 million.

- Retailers using AI-powered customer service saw a 9% higher conversion rate on Black Friday 2024, according to Salesforce.

- The use of AI agents rose 31% year over year, adding to an estimated $60 billion boost in holiday sales.

Break holiday sales records without breaking your site — get 70% off Bluehost WooCommerce hosting plans.

Black Friday spending trends: Predictions for the future

Artificial intelligence is reshaping how consumers shop and how retailers sell this holiday season.

- AI is transforming how consumers shop during the holiday season, with more people choosing online sales over traditional in-store shopping.

- During Black Friday week, shoppers spent over $41 billion online, including $10.8 billion on Black Friday, proving that online Black Friday spending now dominates.

Source: How AI is reshaping Black Friday shopping this year

Break holiday sales records without breaking your website — with Bluehost

At Bluehost, we help businesses build a strong and reliable online presence. From domain registration to web hosting, our services are designed to keep your website fast, secure and ready for growth.

When online shoppers flood the internet during Black Friday and Cyber Monday, websites often struggle to keep up.

But with Bluehost, your site stays stable and speedy even when traffic spikes. Whether you’re running a small store or managing large-scale holiday sales, we make sure your website never misses a sale.

And this Black Friday, we’re making it even better. Bluehost is rolling out some exciting deals:

- 70% off Business and eCommerce Essentials

- 40% off Managed VPS Plans

- 20% off Design and Marketing Services

- 25% off SiteLock/CodeGuard/Premium SSL

- $2.99/mo coupon for Yoast Premium (1 year)

- Free cPanel license with a special Managed VPS offer

Note: These offers are valid for the ongoing holiday season, for the latest pricings and offers visit Bluehost website.

It’s the perfect time to upgrade your hosting, boost your site’s performance and prepare for record-breaking holiday shopping traffic.

This holiday season, grow your business confidently with Bluehost hosting, powering your success.

Final thoughts

Black Friday isn’t just a sale anymore, it’s the biggest shopping event of the year. Whether people shop in person or scroll through mobile apps for online deals, including cyber week sales, one thing’s certain: holiday spending is soaring.

Previous year, online shoppers drove record online spending and this year’s Cyber Monday sales and global online sales are set to climb even higher. As discounts hit record highs, more people prefer to shop online, adding to the surge in online orders and customer spending.

So, as the Christmas shopping rush begins, focus on being ready — fast site, smooth checkout and great offers can turn browsers into buyers in no time, maximizing customer spending .

Launch your website with Bluehost and get fast, secure hosting that’s optimized for ecommerce growth.

FAQs

Yes. Black Friday sales 2024 broke records again. Global spending and online sales surged, with consumers Black Friday consumer spending more through digital shopping and mobile apps than ever before. It marked one of the biggest Black Friday weekend performances in recent years.

Not at all. Despite tighter budgets, online purchases and holiday purchases rose steadily. Both desktop shopping and mobile app transactions showed strong growth in Black Friday sales, driven by early October sales events and attractive average discounts across major retailers.

Electronics, apparel and furniture led Black Friday sales, followed closely by toys and skincare. These categories made up the bulk of global Black Friday consumer spending, showing shoppers’ focus on practical and giftable items during the Black Friday online sales.

Black Friday sales typically see a 9–10% year-over-year jump. In 2024, consumers spent billions more online, with average cart value and desktop purchases rising significantly compared to regular days, especially during holiday season and Cyber Monday sales.

Many shoppers now start Black Friday shopping early nearly a third begin during October sales events, while the rest dive in over Black Friday weekend, often visiting physical stores as well . Early deals, push notifications and seamless mobile apps make it easier than ever to plan and complete holiday purchases ahead of time.

Global online sales are projected to exceed $320 billion, driven by AI-powered shopping, mobile dominance and early October deals.

Use Bluehost hosting for high uptime, caching and CDN performance. Add CodeGuard backups and SSL to handle peak sales securely.

Write A Comment